Paytm Q1FY24 Results: EBITDA before ESOP grows to ₹84 Cr

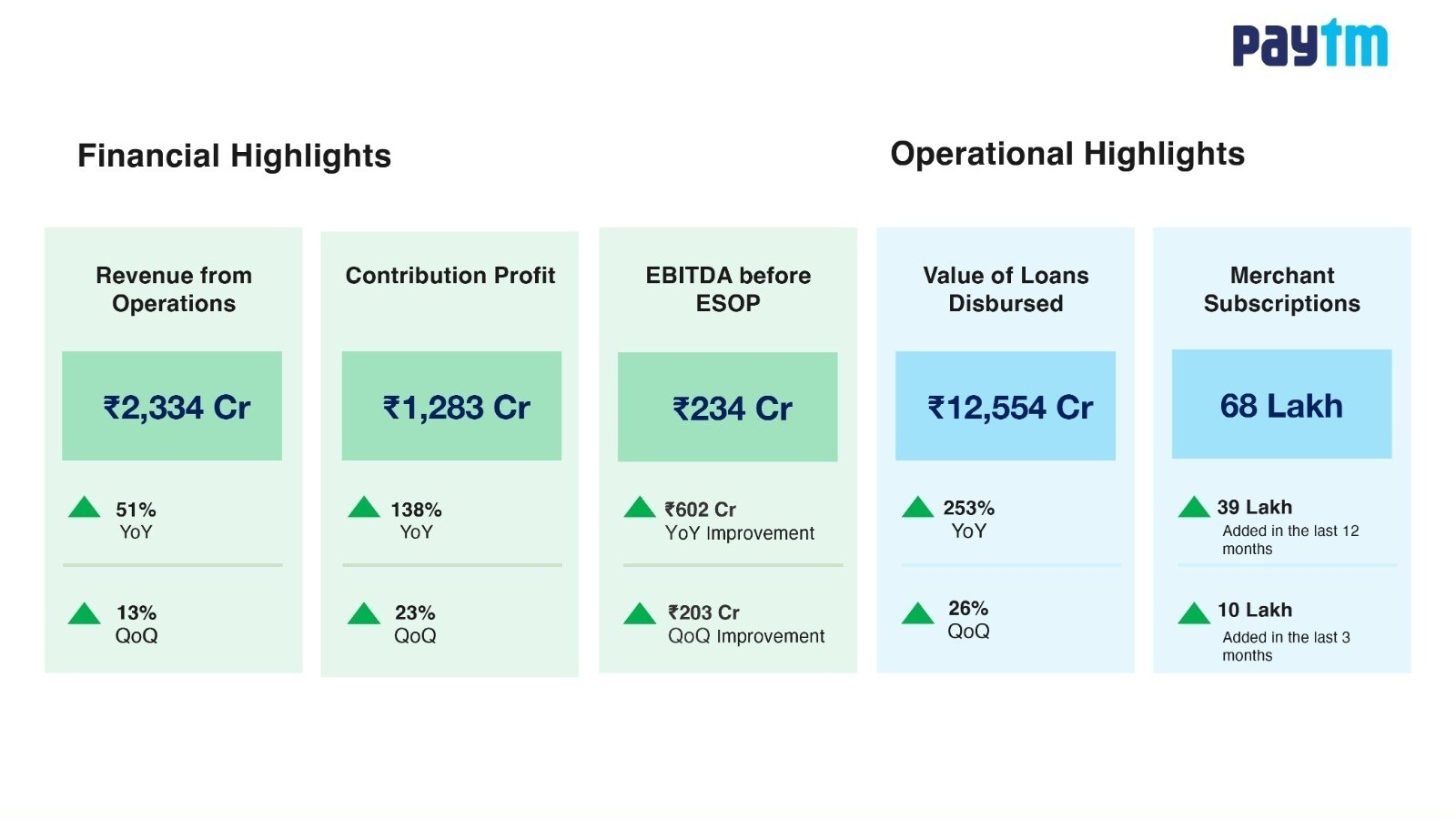

Paytm, India's leading payments and financial services company and the pioneer of QR and mobile payments, has announced Q1FY24 results where it has reported a massive improvement in EBITDA before ESOP cost of ₹84 Cr as compared to ( ₹275 Cr) in Q1 FY 2023. The company's revenue from operations has seen a growth of 39% YoY to ₹2,342 Cr.The company's EBITDA before ESOP margin stood at 4% on the account of continuous surge in profitability due to robust revenue growth, increasing contribution margin and operating leverage. This does not include any UPI incentives, since it recorded UPI incentives after government issued the gazette notification, which is generally in the second half (H2) of the financial year. It managed to increase EBITDA while continue investment in growth. It has sea...